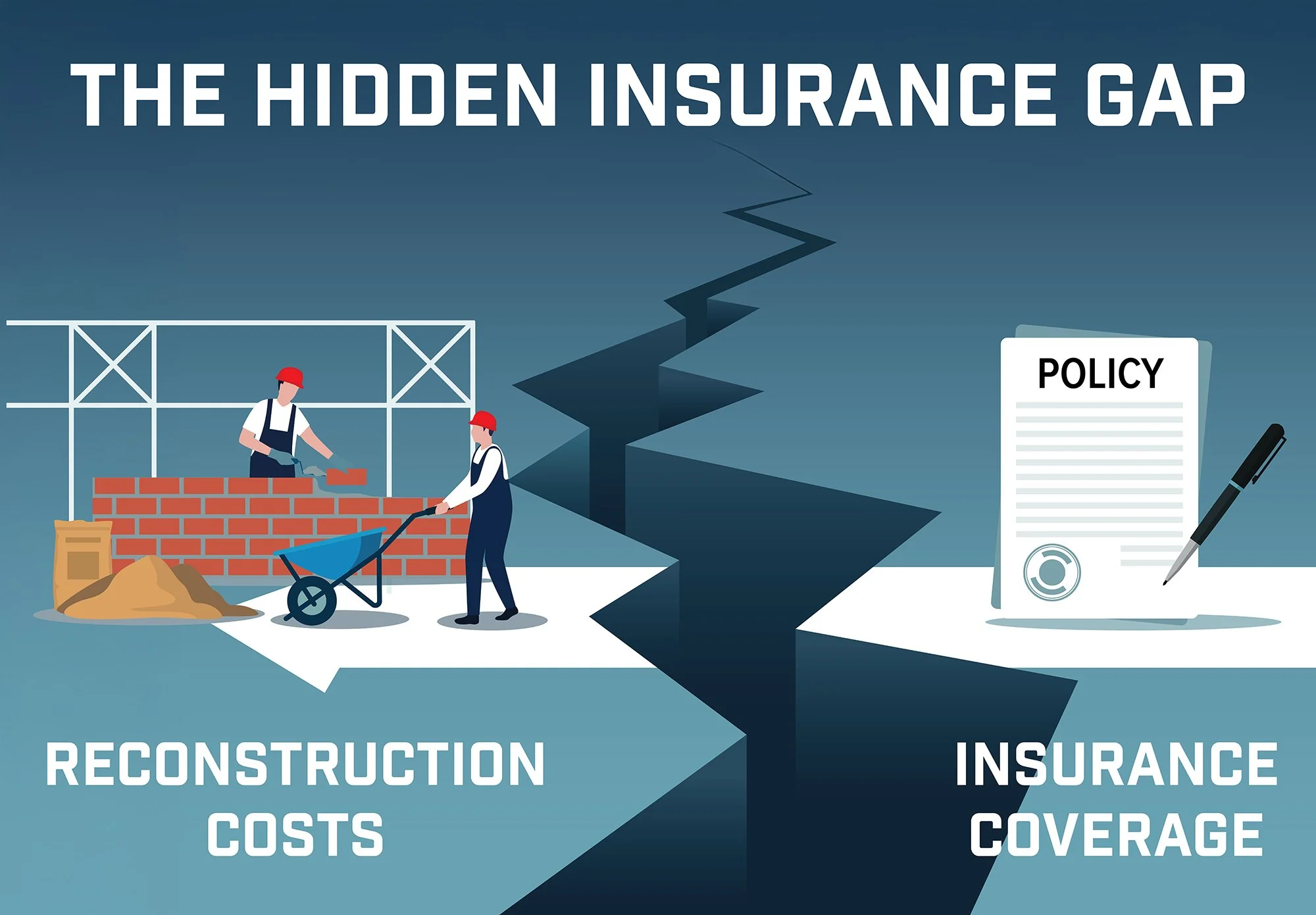

Watch your step: There's a hidden insurance gap

Here’s why one-in-four houses of worship can’t afford to rebuild after a disaster.

When it comes to your facility’s insurance value, what you don’t know can hurt you. Undocumented or incorrect information about your building is akin to an undetected disease. All seems well – until it’s not.

We’ve found that at least one-in-four houses of worship is under-insured. That means their policies will not pay enough to fund reconstruction in the event of a total loss. Although we hope a day of disaster never comes, organizations purchase property insurance for this very reason. In this interview, Charles Dare, Building Valuations and GIS Manager for AccuValuations, demystifies building values and the process of determining them. AccuValuations is a partner of Ministry Pacific.

Q: First of all, what is a building valuation? How is it different from market value or an assessed tax value?

A: Building valuation is a calculation for the total cost to rebuild the structures on your property. A county’s assessed tax value is calculated for the buildings and the land they sit on. Market value is the price the property – buildings and land – would likely sell for. Insurance, however, is strictly concerned about how much it costs to rebuild your structures in what’s called “like kind and quality” materials and design.

Q: Why should houses of worship be concerned with the accuracy of their building valuations?

A: Some industry estimates have determined that commercial properties (including houses of worship) are under-insured by more than 30%. Most first-time clients we survey are between 22% and 26% under-insured for the value of their buildings. This means that in the event of a total loss, about a quarter of the cost to rebuild is not covered under their policy.

Q: What can result if the insurance value is significantly lower than it should be?

A: Often, this results in an inability to rebuild or the lack of sufficient funds to move to another property. Most clients will spend years or decades trying to recover from a loss when the property is not fully insured to its value. Some never recover or reopen.

“Most clients will spend years or decades trying to recover from a loss when the property is not fully insured to its value. Some never recover or reopen.”

Q: Most clergy have no expertise in this area. And even if they did, they don’t have time. How can they manage it?

A: AccuValuations exists for this very purpose. Most ministry and nonprofit staff focus on their cause, not worst-case scenarios. That’s where we come in. It’s our job to determine whether your property is fully insured under your policy. Our valuation report calculates the cost to rebuild your facility, then compares that to your policy. Our team includes experts in geospatial data analysis, construction engineering and design, and facilities maintenance and management. Our skill sets, experience, and practical knowledge, provide the most well-rounded valuation possible. This assures you and your leadership that, if the worst-case scenario happens, you will be able to get back to your mission – even in the event of a total loss.

Q: What kinds of data sources do you use? How do you know you’re creating an accurate report?

A: When we get a request, we start by replicating the property in geospatial mapping software. We use county assessor parcel boundaries, current and historical imagery, road networks, flood zones, fire risk zones and many other sources. In this software, we map your entire property and create footprints for every building, trailer, and storage structure. Then we look at other publicly available facility information, such as Google Street View, Google Earth 3D, websites, social media and other digital content. We use these platforms to build a 3D view of the interior and exterior, and of the changes made to them over time. We then enter those details into our rating software. This program accounts for current construction labor and material costs in every U.S. ZIP Code. We then send you the results and communicate to ensure any discrepancies are corrected.

Q: Are there any other ways you use the data?

A: We have dashboards that allow us to monitor every property we have ever valued. We’re monitoring for information about wildfires, hurricanes, tornadoes, and other severe weather events in real time. Our alert system notifies us of any threats in proximity to our customers. If an alert is triggered, we can contact your agent, who will then alert you. In 2025, during the Eaton Fire in Altadena (Los Angeles County), we alerted an insurance agent that a client was located in the evacuation zone. We were able to do this within minutes of the official announcement. This enabled the agent to quickly pass this alert on to the client.

Q: If a house of worship believes its insurance building values are not accurate (or doesn’t know), what can they do?

A: Please contact us at service@accuvaluations.com for a complimentary consultation. We’ll cover what is included in each report, what information we gather, and how we can help you ensure your facilities are fully covered in your policy. As a matter of course, we do not review your existing policy or its limits because we want our report to be completely objective. Our results are not influenced by your current policy or those of other insurers. Our goal is to determine the amount of coverage you need to rebuild.

Charles Dare

Charles Dare is the Building Valuations and GIS Manager for AccuValuations.